- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

RoofAutomotive partsImport RepresentationFee Analysis and Cost Optimization Guide

Author: Seniorforeign tradeservice expert with 20 years of industry experience, this article will systematically analyze the core points of clothingExport RepresentationService Account Manager (20 Years of Experience)

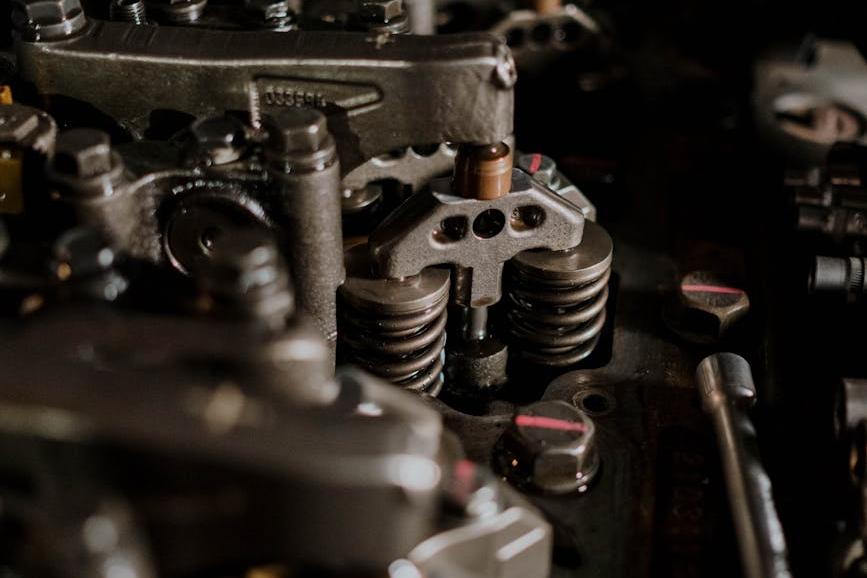

Against the backdrop of the booming global automotive aftermarket, the import demand for roof auto parts (such as roof racks, sunroof components, roof boxes, and panel brackets) continues to grow. However, complex import processes and hidden costs often subject enterprises to financial pressure and compliance risks. As a foreign trade service expert with 20 years of experience, this article will systematically analyze the composition of roof accessories import agency fees and provide cost optimization strategies to help enterprises achieve efficient imports.solarI. Core Components of Roof Auto Parts Import Agency Fees

Import agency fees typically consist of

Logistics feesBasic service fee,Taxes and duties,Miscellaneous expensesandfour major components, as detailed below:Basic Service Fee (Core Cost of Agency Services)

: Includes document review, customs declaration, and tariff classification (HS Code) services. Roof parts require precise classification (e.g., roof racks fall under 9, sunroof components under 9). Misclassification may lead to tariff deviations or rejection.

- Customs Clearance Agency Fee: Includes compliance review and submission of documents such as bills of lading, invoices, packing lists,

- Document Processing Feecertifications (some parts require mandatory certifications), etc.It is recommended to verify through the following methods:,3C: Coordination services between the agency company and shipping companies, freight forwarders, and warehouses, involving booking, transportation tracking, and exception handling.

- Logistics coordination feeIndustry Reference Rates:

Typically 0.5%-2% of the cargo value, or fixed service package fees (e.g., RMB 000/shipment). Taxes (Core Part of Import Costs)

: Determined based on HS Code and origin policies. For example, the general tariff rate for roof racks is about 10%. If originating from countries with free trade agreements with China (e.g., ASEAN, RCEP members), preferential rates of 0%-5% may apply.

- TariffDetermined according to HS Code and rules of origin policies. For example, the general tariff rate for luggage rack imports is approximately 10%, while products originating from countries that have signed free trade agreements with China (such as ASEAN or RCEP member states) can enjoy preferential tariff rates of 0%-5%.

- Value - Added Tax (VAT)Unified 13% (2023 standard), calculation formula: (CIF price + duty) × 13%.

- Consumption TaxOnly applies to certain high-energy-consuming or luxury accessories, roof accessories are generally not involved.

Key tips: Some companies overpay duties due to improper use of rules of origin or misclassification. For example, a company mistakenly classified aluminum alloy roof racks as aluminum products (8% duty rate) when the correct classification as auto parts (6% duty rate) could save 2% in costs.

3. Logistics costs (Maritime Transportation/Air Transportation/Land Transport)

- International freight: Charged by volume (CBM) or weight (ton). Roof accessories are mostly lightweight cargo, so pay attention to the cargo ratio of shipping companies/routes (e.g., 1:500 or 1:1000).

- Domestic Segment Costs: Port storage fees, document exchange fees,Trailerfees, warehousing fees, etc. If customs clearance is delayed, storage fees may surge (e.g., RMB 50/CBM per day after exceeding the limit at Shanghai Port).

4. Miscellaneous fees (easily overlooked hidden costs)

- Inspection Fee: Some accessories require commodity inspection or quality certifications (e.g., EU CE, U.S. DOT), costing approximately RMB 2000-8000 per batch.

- Label Rectification Fee: If the outer packaging lacks Chinese labels, additional labeling is required (approximately RMB 500-1000).

- Exchange rate loss: When agents prepay taxes, exchange rate differences may occur if the rate is not locked in.

II. Cost optimization strategies: Reduce costs and improve efficiency in 5 key areas

1. Commodity classification and duty planning

- Accurate Classification: Engage professional agencies to verify HS Codes to avoid higher duty rates or penalties due to misclassification.

- Rules of Origin: Prioritize purchasing accessories produced in ASEAN or RCEP member countries to enjoy duty reductions.

- Application of Provisional Tax Rates: Monitor the Ministry of Finances annual Duty Adjustment Plan, as some accessories may qualify for provisional rates lower than MFN rates.

2. Logistics plan design

- LCL optimization: Lightweight cargo can be consolidated with heavy cargo to reduce unit freight costs (e.g., under a 1CBM=500KG ratio, weight-based charging is more cost-effective).

- Port Selection: Ports like Qingdao and Nansha have higher clearance efficiency for auto parts and lower storage fees than Shanghai Port.

3. Agent service negotiation

- Tiered pricing: Companies with over 100 annual import shipments can request volume-based pricing, reducing service fees to 0.3%-1%.

- Risk lump-sum model: Choose agents offering all-inclusive flat rates to lock in costs for clearance, transportation, and other processes.

4. Supply chain compliance management

- Advance declaration: Utilize policies like two-step declaration and advance declaration to shorten clearance time and reduce port detention fees.

- Certification pre-arrangement: Complete CCC certification or exemption applications before import (e.g., for parts imported for the purpose of complete export of finished products).

Digital Tool Applications

- Tax Simulation System: Use the tariff calculation tool provided by the agency to calculate tax differences in real-time based on different HS Codes and countries of origin.

- Logistics Tracking Platform: Monitor cargo status to avoid overdue container fees and storage charges.

III. Case Study: Cost Optimization for a Company Importing Roof Racks

Background: A certainCross-border E-commerceThe company imports aluminum alloy roof racks from Germany with a value of USD 50,000, originally planned to declare as aluminum products (8% tariff).

Optimized solution:

- The agency reclassified them as auto parts (6% tariff);

- Switch toChina-Europe Railway ExpressTransportation, saving 30% on freight and 15 days in time;

- Applied for RCEP Certificate of Origin, reducing the tariff to 5%.

Result: Single shipment costs reduced by RMB 28,000, with annual savings exceeding RMB 1.5 million.

IV. Conclusion

Controlling import agency fees for roof auto accessories requires a systematic approach across multiple dimensions, including product compliance, logistics design, tax planning, and agency collaboration. Companies should choose agency service providers with experience in auto parts imports and AEO certification from customs, and optimize supply chain decisions through long-term data accumulation. For further consultation, please contact the author for customized solutions.

(Original content, reproduction requires authorization.)

Note: The data in this article is based on Chinas customs policies in 2023. Actual operations should comply with the latest regulations and contractual agreements.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912